Significant Investor Visa (SIV)

Significant Investor Visa (SIV)

Investor Visa (IV)

A Proud Heritage of Service Excellence

Discover the Value of our Investor Visa and Significant Investor Visa Advice

Download Brochures

Welcome to Australia

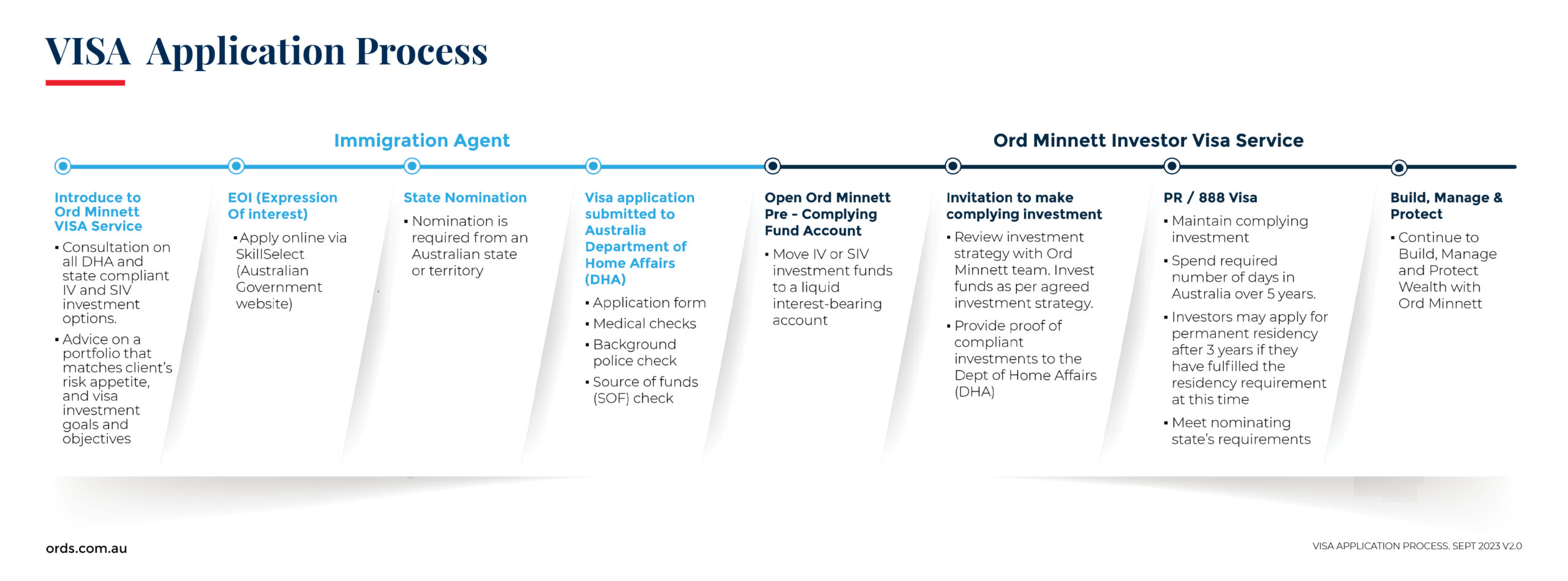

THE ORD MINNETT VISA INVESTMENT SERVICE

Ord Minnett is where Investor Visa applicants belong.

We are Investor Visa (IV) and Significant Investor Specialists (SIV), highly respected and well regarded as Investor Visa leaders in providing excellent support during the IV and SIV application process and a great SIV investment experience.

When you get the right advice, it makes all the difference.

Investor Visa and Significant Investor Visas

The Investor Visa (IV) and Significant Investor Visa (SIV) are five-year pathways to permanent residency for entrepreneurial and high net worth individuals willing to make substantial complying investments in areas of the Australian economy that will drive innovation and the commercialisation of Australian ideas.

Australia’s family friendly quality of life, safe environment, our well-developed education, and public health system make it one of the great places in the world to live.

Our stable and resilient economy, our stable political environment, good governance, and transparent regulatory framework make it a very attractive investment destination. Australia is widely regarded as a safe haven for foreign investments.

Over the last 30 years, Australia’s economic growth rate has averaged 3.2 per cent, which is higher than every other major developed economy in the world. Australia’s global trade links is a major factor in our success. The Asia region is ultra-fast growing, and Australia’s network of 14 free trade agreements across Asia and the Pacific have helped agile Australian businesses rapid expansion.

"Australia’s family friendly quality of life, safe environment, our well-developed education, and public health system make it one of the great places in the world to live."

Ord Minnett's IV & SIV Investment Service

Ord Minnett's SIV Investment Review Service

The Ord Minnett (Ords) Investment Visa Service has been the major provider of both IV and SIV advice since the SIV visa category started in November 2012.

The Ord Minnett (Ords) Investment Visa Service also offers a comprehensive SIV Investment Review Service. We have helped many SIV holders move their SIV investments from poor quality SIV investment products with expensive fee structures, into cost efficient, safe and compliant SIV portfolios.

Our team of Investment Specialists help IV and SIV applicants to establish and maintain compliant and safe SIV investment solutions.

Ord’s Investor Visa and Significant Investor Visa solutions are transparent, flexible and tailored to investor's personal risk profile.

Ord Minnett provides investment solutions for all categories that qualify for the AUD$2.5M Investor Visa and the AUD$5 million Significant Investor Visa, being:

- Venture Capital and Growth Private Equity Funds (VCPE)

- Emerging Companies

- All IV and SIV balancing investment options

Investments are administered through an Investor Directed Portfolio Service (IDPS) which is regulated by the Australian Securities and Investment Commission (ASIC), as permitted under Significant Investor Visa and Premium Investor Visa legislation.

Our Visa Investor Services

The Ord Minnett Investor Visa Service provides financial advice and investment solutions for all categories that qualify for the AUD$2.5M 188b Investor Visa (IV) and the AUD$5 million 188c Significant Investor Visa (SIV), being:

- Venture Capital and Growth Private Equity Funds (VCPE)

- Emerging Companies

- All Balancing investment options

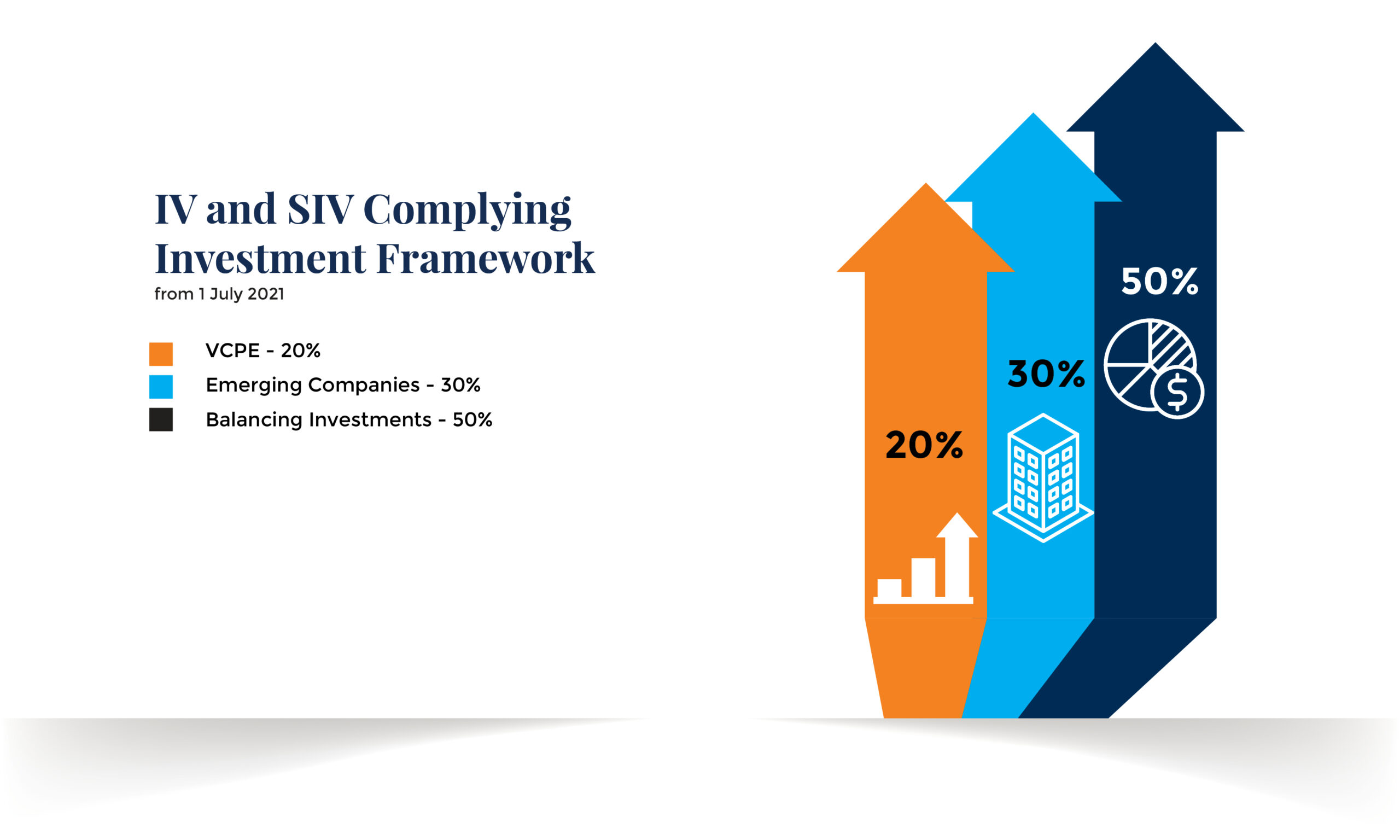

IV and SIV Complying Investment Framework

Why Ord Minnett's IV & SIV Investment Service?

Compliance with the Australian Government’s strict investment criteria is the major issue that concerns IV & SIV applicants. The ongoing compliance with the Mandated SIV Investment Framework is our foremost priority.

Building a bespoke SIV portfolio is the first part of the four-part compliance journey that will last the lifetime of your SIV Investments.

- Each Manager we work with has multiple in-house checks to confirm their compliance with SIV regulations as defined in the Migration Act 1958 and Migration Regulations 1994.

The Ord Minnett Research Team conduct an in-depth investment and compliance analysis of all Managed Funds before adding them to our IV & SIV Approved Product List.

- Each manager has undertaken the mandate to continually review their compliance and confirm this compliance to Ord Minnett on a methodical basis.

- The Ord Minnett Team both corresponds and meets with each Fund Manager, regularly to review and validate both compliance and investment mandates. This process continues right up until you receive your Australian Permanent Residency.

‘Compliance is fundamental to the way in which we conduct our business.’

Post 1 July 2021

Ord Minnett is a leading Australian investment advisory firm with a history dating over 150 years. Services include full-service stockbroking, financial planning, estate planning, portfolio services and qualifying investments for investment immigration. With offices in Australia and one in Hong Kong, over 580 staff and A$59b plus in funds under advice, Ord Minnett is Australia’s trusted name in building wealth for generations.

The Value of Advice

Our corporate values are reflected in everything we do. Establishing and building long-term relationships with our private wealth clients are based on trust that is earned and rewarded with prudent, honest investment advice and successful financial returns. These beliefs underpin our reputation for excellence.

Ord Minnett's team of experienced and bi-lingual advisers can help you with your SIV and wealth management needs.

The major differences between Ord Minnett IV & SIV and other SIV investment providers is that the underlying investment funds we recommend are the best of breed in each investment category. They have a long-proven track records and enable our SIV investors to invest alongside the smart money of sophisticated, professional and institutional investors. Most of our competitors set up unregistered managed funds to exploit applicants who simply want a visa or use a set and forget cookie cutter approach.

We advise clients to use the best of breed registered and regulated managed funds. Best of breed is of course a slang term derived from Pedigree Dog shows. In investment terms it refers to Fund Managers that are the best in their own categories, whether that be Private Equity, Emerging Companies, Commercial Property, Fixed Interest or Large Cap Australian Equities.Over time investment markets and Investor Visa (IV and SIV) legislation will go through many changes. Our advice will keep up with change to ensure you are appropriately invested to help protect your capital and investment performance.

The expertise of our IV & SIV Investment Team make Ord Minnett the ideal partner to assist with your move to Australia.

In addition to managing your IV or SIV investments, Ord Minnett can provide a complete wealth management service. Our research capabilities, and investment insights, will help guide you to build and protect your family’s wealth for generations to come.

Ord Minnett has in-excess of AUD$59 billion in funds under advice. Ord Minnett’s research agreement with J.P. Morgan continues to ensure our clients benefit from access to J.P. Morgan’s Australian capital raisings in the form of Initial Public Offerings (IPOs), placements and other corporate originations.

Ord Minnett provides astute investors with a full suite of private wealth investment services and tailored financial solutions. Our professional team of Advisers ensures our clients are offered specialist stockbroking and financial planning advice, share market insights and bespoke investment solutions.

Ord Minnett leads the IV & SIV market in providing a fee structure that is simple, transparent, and competitive.

Unlike IV & SIV product manufacturers and some advice firms, with Ord Minnett there are no hidden charges, no performance fees, no switching fees or exit fees.

For your IV & SIV portfolio, we do charge an ongoing advice fee on top of the wholesale fee charged by each the fund manager that we recommend. Our Ongoing advice fee provides you with:

- Access to a state-of-the-art Investor Directed Portfolio Service with 24/7 internet access, and the reporting required by the Australian Government.

- Access and advice on market-leading wholesale fund managers and products not available to retail investors,

- Ongoing compliance monitoring of your SIV portfolio,

- Quarterly reports that will include both general market commentary and commentary specific to your own portfolio.

- An agreed schedule of portfolio asset allocation and investment thematic reviews.

Ord Minnett Financial Advisers are registered with ASIC. Under our Financial Advisers' Code of Ethics, Ord Minnett Advisers act with integrity, and in the best interest of each, and every client.

As an Ord Minnett SIV client, you will have access to comprehensive and transparent 24/7 online reporting. The Investor Directed Portfolio Service (IDPS) platform provides you with secure access to allow efficient tracking and management of your investments.

We provide all clients with Quarterly and Annual Reports and statements are also available on request. All clients also have online access to their portfolio daily and can source a range of reports and resources.

The Ord Minnett SIV Investment Service offers a complimentary ‘Concierge Service’ and will be pleased to introduce you to our network of trusted professional service providers.

This panel of professional advisers ranging from International and Australian Tax Advisers, Australian Accounts, Real Estate professionals (including Buyers Advocates and Mortgage Brokers), Immigration Lawyers and Agents, Education Consultants, Healthcare and Insurance Advisers, Logistics / Relocation Specialists and even Prestige Car Dealers.

Whatever your need we should be able to point you in the right direction and help make you transition to Australia as seamless as possible.

Ords expertise as a leading Australian brokerage firm, can greatly assist the entrepreneur when planning their Australia business activities. We offer a number of services to facilitate these ventures including equity and debt raising, initial public offering on Australian Securities Exchange (ASX), M&A, and corporate structural advice. We are also happy to introduce you to various Australian government departments for industrial and commercial development.

meet the team

SIV Specialist Advisers

Brett Morris Waller - Managing Director SIV Investment Service

After a career spanning over 25 years with one of Australia’s big four banks, Brett moved to Asia joining ipac Singapore as a Senior Vice President in August 2005. Brett spent 8 years in Singapore and Hong Kong providing high level financial planning, strategy, risk, superannuation, CPF (Singapore), MPF (HK) and investment advice to expatriates based in Singapore, Hong Kong and the Asian region.

In Singapore Brett was and still is an active member of Keppel Golf Club and the Singapore Cricket Club. Brett also enjoyed a media presence whilst in Singapore and was frequently interviewed by both local and international media on various topics pertaining to financial planning and wealth management. Brett also ran popular “Migrate to Australia” seminars, contributed to lifestyle and trade publications such as Asian Golf Monthly and the Asian Financial Planning Journal.

Joined Ord Minnett in 2012 and established the SIV Ord Minnett Investment Service. Licensed to provide advice in both Australia and Hong Kong.

Areas of Expertise

Investment Adviser to High Net Worth families from across the world, assisting them to grow and protect their wealth by diversifying their investments into developed well-regulated markets.

Industry leading expert for Australia’s Significant Investor Visa (SIV), offering:

- Access to compliant SIV Investment Solutions.

- Diversified Investment approach to suit client’s risk profile and circumstances.

- Safe investments with the protection of capital being of paramount importance.

- Research driven, proactively managed investment process (rather than set and forget).

- Flexible and liquid: Ability to redeem and move between asset classes and investments when appropriate.

- Competitive fee structure and no exit fees.

- SAFE Investment Portfolios. Independent from product issuers.

The Ord Minnett SIV Investment Service is a major provider of SIV Investment advice and has been since the visa category started in 2012. We launched our new SIV2 compliant portfolios (post 1 July 2015 SIV CI framework) on the 1st of July 2015. These portfolios include the required investment into Venture Capital / Private Equity, Emerging Companies and Balancing Investments.

As required by Australian regulations, all SIV related investment advice and investments will be made under Ord Minnett's Australian Financial Services Licence (AFSL).

FAQ

Significant Investor stream subclass 188, (Provisional), or the Business Innovation and Investment (Provisional) visa. This Visa is designed for people who would like to invest at least AUD5 million into a complying Australian-managed investment funds for the duration of the provisional visa validity and reside in Australia for an average of 40 days a year for primary visa holders.

Significant Investor stream subclass 188 (Provisional). This Visa is designed for people who would like to invest at least AUD5 million into a complying Australian-managed investment funds for the duration of the provisional visa validity and reside in Australia for an average of 40 days a year for primary visa holders.

A provisional visa for high net-worth individuals who are willing to invest at least AUD5 million into complying significant investments in Australia and want to maintain business and investment activity in Australia.

Stay: Up to 5 years.

The Business Innovation and Investment - provisional / subclass 188 is a state nominated provisional visa which is valid for five years. It is a pathway to permanent residency, through the Business Innovation and Investment (Permanent) (subclass 888) visa.

The Australian Government's Significant Investor Visa (SIV) scheme offers an opportunity for high-net-worth migrant investors to apply for permanent residence. The visa conditions require a minimum investment of AUD5 million for five years split across a mandated set of SIV complying investments.

Significant Investor Visa (SIV) holders are required to invest AUD5 million into complying significant investments for a minimum of five years before being eligible for a permanent visa.

The Australian and state governments all strongly recommend that you obtain professional financial advice to enable you to fully understand your investment options and compliance requirements.

You can use the government’s Moneysmart Financial Advisers to check your financial advisor holds the appropriate registration.

You should not rely on migration agents or fund managers for financial advice.

Migration Agents and Lawyers are not licensed to give financial advice. Fund managers can give product advice on their own financial services and products; however, this is not unbiased financial advice.

The Ord Minnett Investor Visa Service team are ASIC Registered Financial Advisers.

The Investor Stream — Individuals must pass a points test, commit AUD2.5 million into a complying Australian-managed investment fund for the duration of the provisional visa validity, and reside in the country for at least two years.

188B investment visa, (Business Innovation and Investment (Provisional) visa (subclass 188B) – Investor stream). 188B visa is only available to applicants who are nominated by an Australian State or Territory government. This is a 5-year temporary visa, for people who want to make a designated investment in an Australian state or territory.

The Australian and state governments all strongly recommend that you obtain professional financial advice to enable you to fully understand your investment options and compliance requirements.

You can use the government’s Moneysmart Financial Advisers to check your financial advisor holds the appropriate registration.

You should not rely on migration agents or fund managers for financial advice.

Migration Agents and Lawyers are not licensed to give financial advice. Fund managers can give product advice on their own financial services and products; however, this is not unbiased financial advice.

The Ord Minnett Investor Visa Service team are ASIC Registered Financial Advisers.

The Australia Investor Stream Visa program is a three-year investment-based residence program that leads to permanent residence. The good news is that after four years, you can apply for citizenship in Australia.

No, buying a property in Australia does not secure someone Permanent Residency. You must invest at least AUD2.5 million. Even when doing so, you'll only get a provisional visa, which provides temporary residence, which can lead to permanent residency.

The Investor Stream — Individuals must pass a points test, commit AUD2.5 million into a complying Australian-managed investment fund for the duration of the provisional visa validity, and reside in the country for at least two years.

Yes. Any permanent resident of Australia can get a mortgage without seeking special permission. Similarly, expats living abroad with a temporary visa can purchase a property in Australia.

AUD5 million for the Significant Investor Visa (SIV) Stream:

Willing to invest at least AUD5 million in a portfolio of investments that comply with Australian and state government requirements. Must also meet certain milestones and maintain your investment activity in Australia.

AUD2.5 million for the Investor Visa (IV) Stream:

Willing to invest at least AUD2.5 million in a portfolio of investment that comply with Australian and state government requirements. Must also meet certain milestones and maintain your investment activity in Australia.

As a permanent resident of Australia, you generally can, remain in Australia indefinitely. Work and study in Australia, buy property and gain access to Australia's national health scheme, Medicare.

A permanent resident visa lets you live in Australia and will allow you to claim all Centrelink payments.

Yes, as a PR you can live permanently in Australia for as long as you like and gain access to other benefits such as schooling and buying property.

You can enroll in Medicare if you live in Australia on a permanent resident visa. Complete a Medicare enrolment form and mail or email it with your supporting documents to Medicare Enrolment Services.

Medicare is offered to all permanent residents and Australian citizens. Hence, all expats that qualify as permanent residents are allowed coverage. However, this doesn't mean that all visitors to Australia may get Medicare. For example, expats moving to Australia who only have a working visa aren't eligible.

The SIV (188C) and IV (188B) complying investment rules were changed by the Australian Government in July 2021. Ord Minnett offers funds that are complying investments for the purposes of SIV and IV, both before and after 1 July 2021. The date of your visa application will determine which set of rules apply to you.

Please always refer back to the relevant government website for any further information or updates to the complying investment rules.

- Department of Home Affairs - Significant Investor Stream

- Department of Home Affairs - Investor Stream

The definition of a financial adviser is an individual who is, an Australian financial services (AFS) licensee, an authorised representative, employee, or director of an AFS licensee, or an employee or director of a related body corporate of an AFS licensee.

Ord Minnett Advisers are Financial Advisers Registered with the Australian Securities and Investment Commission (ASIC).

Generally, it is easier and cheaper to structure and promote a fund as an unregistered fund compared to a registered fund. A registered fund is a far more onerous undertaking with a multitude of compliance, governance, audit, and reporting requirements which are not required for an unregistered fund.

Generally, a managed investment scheme must be registered if it has more than 20 members or is promoted by a person who is in the business of promoting managed investment schemes: see section 601ED of the Corporations Act.

Yes, there is no advantage in buying into an unregistered mutual fund. The odds of fraud are high, and it is unlikely that you will beat the performance of similar registered funds.

Ord Minnett (Ords) is a leading Australian wealth management group, offering a full-service stockbroking, financial planning, funds management and portfolio services.

In Australia, you cannot get citizenship directly by investment. Applicants can be granted a five-year visa by investment of AUD1.25 million or AUD5 million.

Applicants who maintain their investment can then obtain permanent residency in Australia. An Australia Permanent resident can apply for Australian Citizenship after certain criteria are met.

proud heritage & history

Ord Minnett

Ord Minnett (Ords) is a leading Australian wealth management group, incorporating full-service stockbroking, financial planning, funds management and portfolio services. Founded in 1951 by Charles Ord and Jack Minnett, after meeting in the Australian Imperial Force during the Second World War, Ords has grown via strategic mergers and acquisitions of Australian financial firms with corporate origins dating back to 1872. Focused on service excellence, Ord Minnett is a highly respected name in the Australian investment landscape.

testimonials

SIV Client Testimonials

SIV Updates | Newsletters

SIV Ord Minnett Newsletter | February 2024

In this month’s newsletter we will cover:

- SIV in the news and the ongoing Immigration Review

- 888 visa applications being approved.

- Happy Lunar New Year of The Dragon

SIV Ord Minnett Newsletter | September 2023

In this month’s newsletter we will cover:

- BIIP Allocations for fiscal 2023 – 2024

- An outline of the Government’s Migration Strategy

- IV and SIV Review Service

SIV Ord Minnett Newsletter | April 2023

- The immigration review

- Our new staff member

- Hong Kong Visit

Traditional Chinese | 繁體中文

SIV Ord Minnett Newsletter | April 2023

- 移民政策審核

- 我們的新成員

- 香港之行

Simplified Chinese | 中文

SIV Ord Minnett Newsletter | April 2023

移民政策审核

我们的新成员

香港之行

SIV Ord Minnett Newsletter | February 2023

- The ongoing immigration reviews

- State Nominations are still closed

- Investor Immigration Programs around the world

- Hong Kong opens for business

SIV Ord Minnett Newsletter | January 2023

- The ongoing Immigration Review

- Australian States remain closed for BIIP nominations.

- Business as usual over the Luna New Year holiday period.

Get in Touch

Start a Conversation with an Ord Minnett SIV Specialist Adviser to begin your investment journey to Australia.

'SIV Advice Specialists'